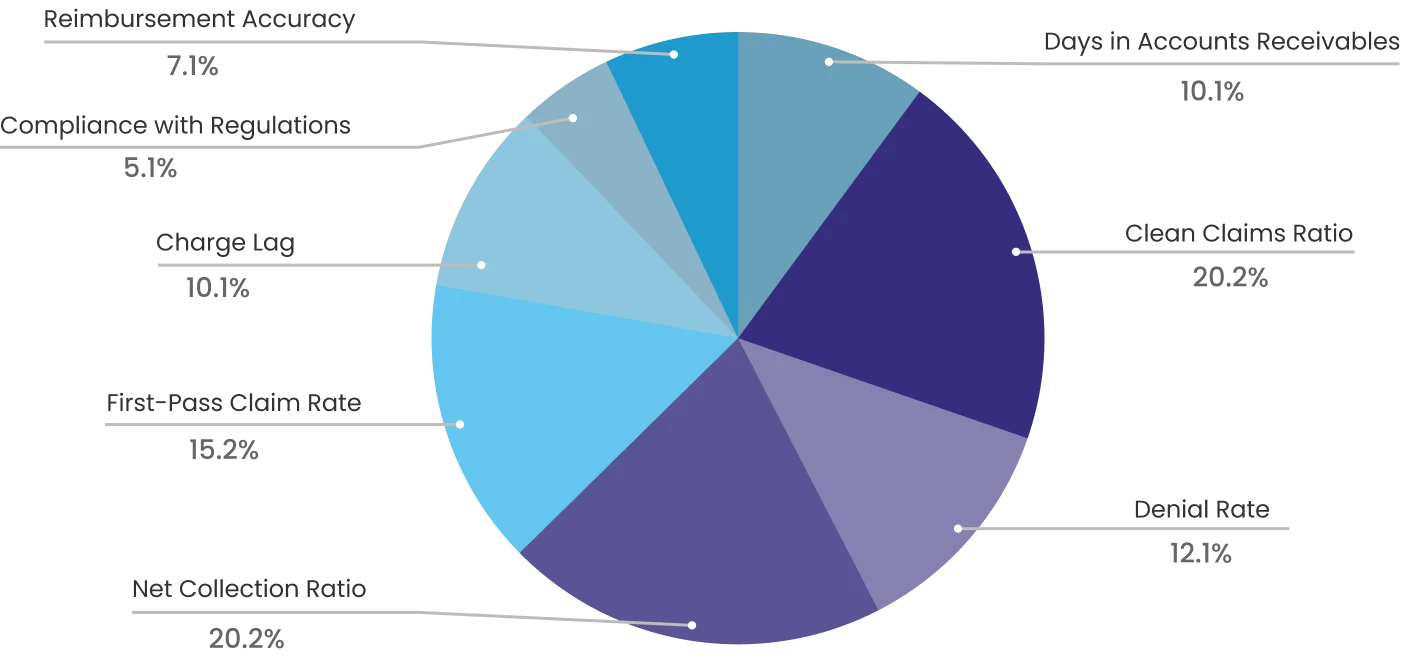

For large practices aiming to optimize their revenue cycle management and achieve a faster Return on Investment (ROI), focusing on key performance indicators (KPIs) is essential. Crucial KPIs such as Days in Accounts Receivable, Claim Denial Rates, and Net Collection Rate provide valuable insights into the billing process's efficiency, highlighting the time it takes to collect payments, the frequency of claim denials, and the effectiveness of revenue collection efforts.

Monitoring the Clean Claims Rate and Cost to Collect also reveals the success rate of first-time claim submissions and the financial efficiency of the collection process, respectively. By tracking these metrics, practices can identify areas for improvement, streamline their billing operations, and enhance financial health.